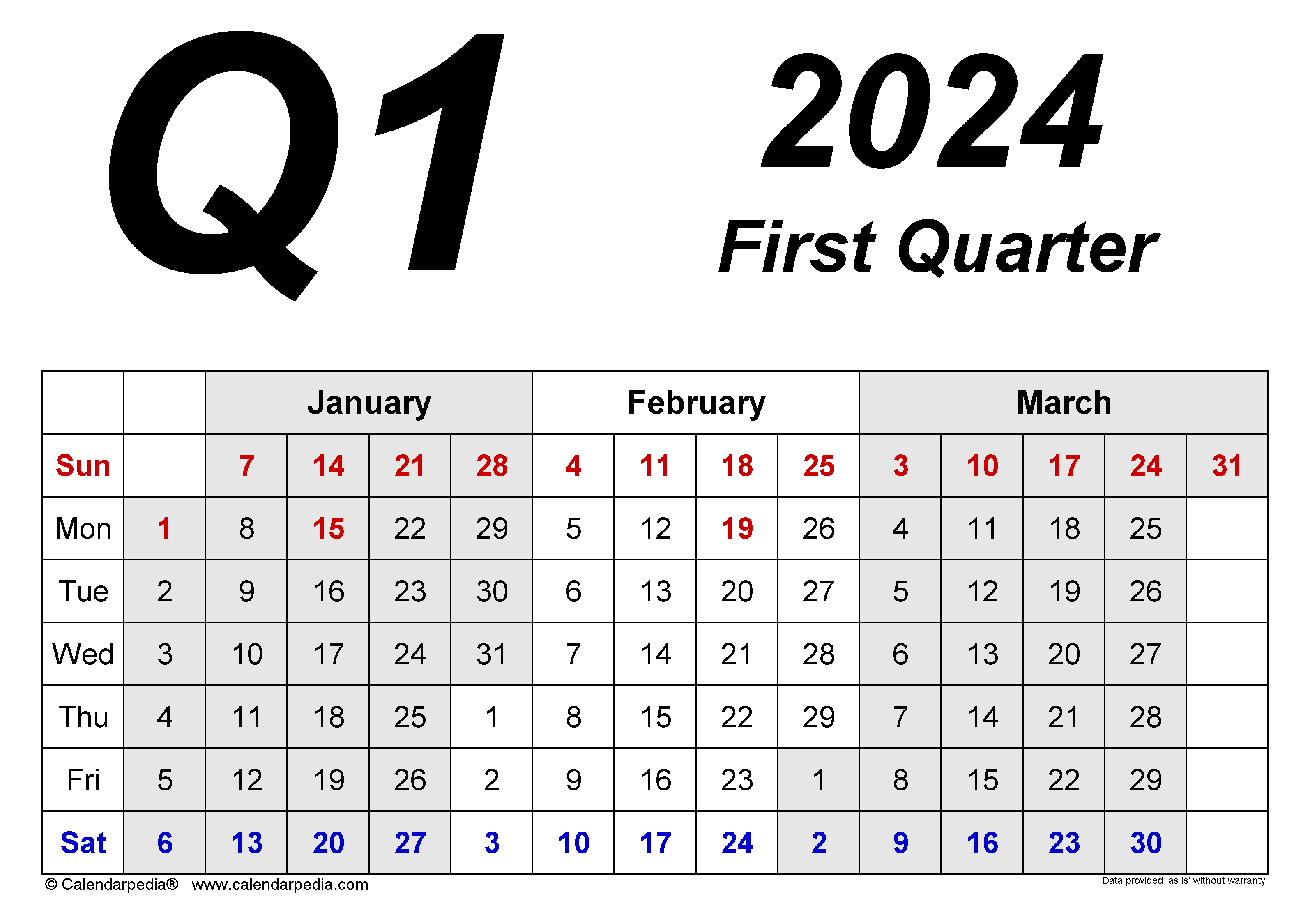

Quarterly Estimated Tax Payments 2024 Dates 2024. The final quarterly payment is due january 2025. In general, quarterly estimated tax payments are due on the following dates in 2024:

Third estimated tax payment for 2024 due. Professional tax (pt) on salaries for may 2024 (note:

Washington — The Internal Revenue Service Today Reminded Taxpayers Who Didn't Pay Enough Tax In 2023 To Make A Fourth Quarter Tax Payment On Or Before Jan.

Determine if you’re required to make estimated tax payments for 2024 or if you meet an exception.

Knowing These Dates Will Help Ensure That You Pay Your Taxes On Time And Avoid Any Potential Penalties.

Deadline to file your extended 2023 personal tax return.

2024 First Quarter Estimated Tax Payment Deadline Is April 15.

Images References :

Source: aubreeqnatasha.pages.dev

Source: aubreeqnatasha.pages.dev

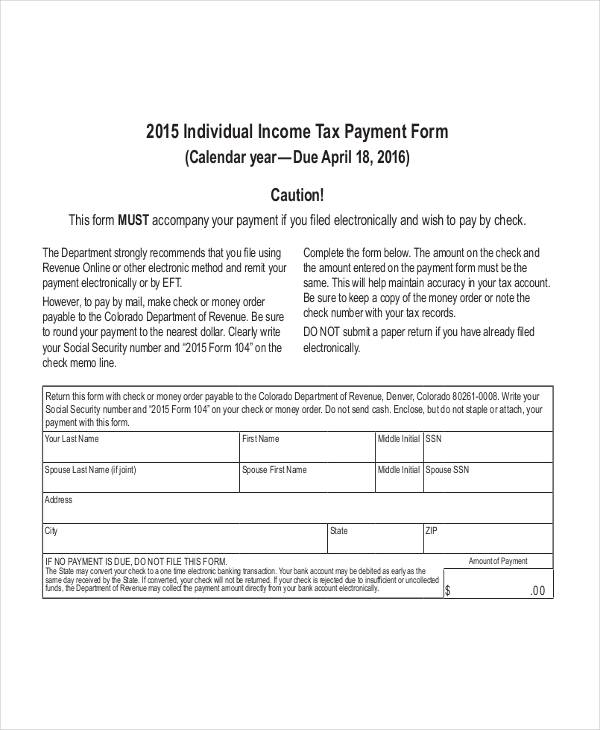

Quarterly Tax Payment Dates 2024 Reeva Celestyn, 16 to avoid a possible penalty or tax bill when filing in 2024. 1q — april 15, 2024.

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg) Source: bettinewheida.pages.dev

Source: bettinewheida.pages.dev

When Are Quarterly Taxes Due 2024 Amity Felicity, 2024 quarterly estimated tax due dates mirna tamqrah, page last reviewed or updated: Required payment deadline for any taxable income earned from april 1 to may 31, 2024.

Source: trixyqkerrill.pages.dev

Source: trixyqkerrill.pages.dev

2024 Federal Tax Brackets And Rates Rasla Cathleen, Second quarter estimated tax payment due; Due dates that fall on a weekend or a legal holiday are shifted to the next business day.

Source: calendar-printables.com

Source: calendar-printables.com

Tax Due Date Calendar 2024 Calendar Printables, Who should make estimated quarterly tax payments? Third estimated tax payment for 2024 due.

Source: www.youtube.com

Source: www.youtube.com

How to Pay Quarterly Taxes Online 2024 YouTube, Payment for income earned from april 1 through may 31, 2024. 2024 tax return calendar printable word searches, why is tax day 2024 on.

Source: www.2024calendar.net

Source: www.2024calendar.net

2024 Tax Refund Calendar 2024 Calendar Printable, In general, quarterly estimated tax payments are due on the. First estimated tax payment for tax year 2024 due.

Source: theadorawmarna.pages.dev

Source: theadorawmarna.pages.dev

Estimated Tax Payments 2024 Address Hetty Philippe, *you do not have to make the payment due on january 15, 2025, if you file your 2024 tax return by january 31, 2025 and pay the entire balance due with your return. Paying taxes can be a tricky process, especially when dealing with quarterly estimated tax payments.

Source: katushawcasey.pages.dev

Source: katushawcasey.pages.dev

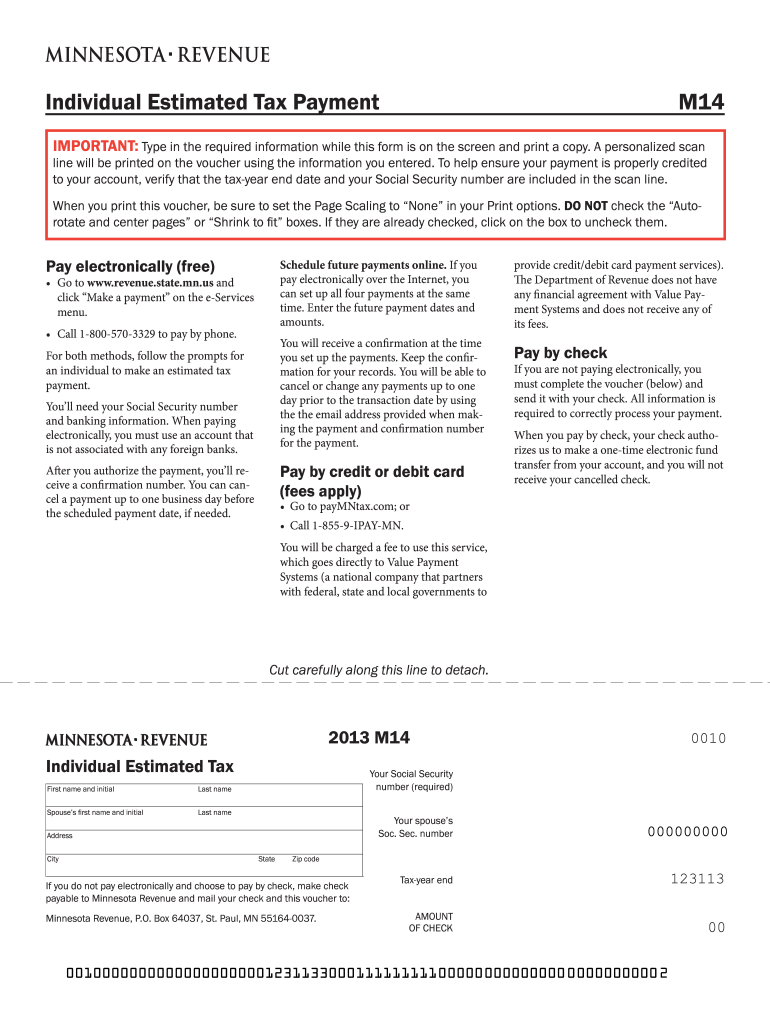

Irs Payment Schedule 2024 Anthe Jennilee, May 15, 2024, 7am eastern time through july 15, 2024, 7am eastern time. When are quarterly taxes due 2024 amity felicity, quarterly estimated ptet payments for tax year 2024 are due march 15, june 17, september 16, and december 16, 2024.

Source: ellaqloleta.pages.dev

Source: ellaqloleta.pages.dev

Federal Estimated Tax Payments 2024 Form Bibi Marita, July 15, 2024, 7am eastern time through october 15, 2024, 7am eastern time. Second quarter estimated tax payment due;

Source: adrianqdrusilla.pages.dev

Source: adrianqdrusilla.pages.dev

Mn Estimated Tax Payment Dates 2024 Arlen Betteann, Payment for income earned from april 1 through may. The final quarterly payment is due january 2025.

Quarterly 941 Due Dates 2024 Seana Courtney, 624 Madeira Boulevard Unit 624, Melville, Ny 11747 Is Pending.

2q — june 17, 2024.

For Taxpayers Who Are Required To Make Estimated Tax Payments, It Is Important To Be Aware Of The Irs Deadlines.

What are the filing dates for federal quarterly estimated tax payments?